2. Healthcare Benefits

The objectives of this chapter encompass a comprehensive exploration of healthcare benefit programs, spanning historical context, structural intricacies, design considerations, cost containment strategies, and emerging trends. The specific aims include:

Presenting a Brief History of Healthcare Benefits:

Unveiling the historical evolution of healthcare benefits to provide a contextual foundation.

Explaining the Structure of Healthcare Benefit Plans:

Delving into the intricate architecture of healthcare benefit plans, elucidating their components and organizational frameworks.

Discussing Design Issues Related to Healthcare Benefit Plans:

Analyzing the nuanced considerations involved in crafting effective and employee-centric healthcare benefit plan designs.

Evaluating Cost Containment Issues Related to Healthcare Benefit Plans:

Scrutinizing strategies and mechanisms aimed at curbing costs within healthcare benefit plans without compromising quality.

Introducing Consumer-Driven Healthcare Plans:

Unveiling innovative approaches such as consumer-driven healthcare plans, exploring their principles and implications.

Discussing the Accounting Implications of Healthcare Benefit Plans:

Examining the financial accounting intricacies associated with healthcare benefit plans, ensuring a comprehensive understanding of their fiscal dimensions.

Addressing Issues Related to Post-Retirement Health Plans:

Exploring the unique challenges and considerations tied to post-retirement health plans, recognizing their long-term implications.

Discussing Financial Issues Related to Healthcare Benefit Plans:

Examining the broader financial landscape surrounding healthcare benefit programs, considering budgetary implications and financial sustainability.

Explaining Tax Dimensions of Healthcare Benefit Plans:

Unraveling the tax implications inherent in healthcare benefit plans, shedding light on regulatory frameworks and considerations.

Introducing the International Financial Reporting Standards and Employee Health and Welfare Plans:

Providing insights into the global context by introducing the International Financial Reporting Standards and their relevance to employee health and welfare plans.

In essence, this chapter aims to equip readers with a holistic understanding of healthcare benefit programs, addressing not only their historical evolution and operational intricacies but also delving into critical financial, design, and regulatory dimensions that shape the landscape of employee health and welfare.

A healthcare benefit program serves as a safeguard for employees, shielding them from the financial implications of medical expenses. It operates by assessing the collective risk associated with healthcare needs, spanning from minor incidents to major emergencies within a targeted group. The primary objective is to establish a financial reservoir, ensuring the availability of funds to cover medical costs promptly as employees or their dependents encounter them.

As defined by the Health Insurance Association of America, health insurance is characterized as "coverage that provides for the payments of benefits as a result of sickness or injury." In essence, the healthcare benefit program is meticulously crafted to furnish employees and their dependents with a robust shield against potential financial setbacks arising from medical expenditures, encompassing both routine and critical healthcare requirements.

A Brief History of Healthcare Benefits

Prior to the 1930s, the onus of healthcare expenses rested squarely on the shoulders of the ailing or injured individuals and their families. However, the landscape underwent a significant shift post the Great Depression, giving rise to the inception of the inaugural Blue Cross plans. The late 1930s witnessed the integration of physicians into the equation with the establishment of Blue Shield plans. Through the 1940s, Blue Cross and Blue Shield emerged as the primary purveyors of healthcare protection plans.

While the proliferation of Health Maintenance Organization (HMO) plans is commonly attributed to the 1950s, there is compelling evidence challenging this notion, as exemplified by the initiation of Kaiser plans in the late 1920s.

Witnessing the success of Blue Cross and Blue Shield, insurance companies ventured into the realm of medical insurance. They introduced hospital coverage initially and subsequently expanded their offerings to encompass doctor charges and surgical procedures.

The advent of national health insurance marked a pivotal moment as the federal government intervened on behalf of the elderly and the impoverished. Medicare, catering to individuals over 65, was financed through a combination of government revenue, premiums from enrollees, and taxes from both employers and employees. Complementing this initiative, Medicaid was established to provide healthcare protection for low-income wage earners.

From the 1970s onward, the landscape of healthcare benefits underwent a myriad of design changes. The ensuing chapters of this book delve into the intricate details of these ever-evolving dynamics, primarily propelled by the driving force of cost considerations.

The Prevalence of Healthcare Benefit Plans

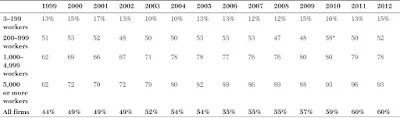

The latest census report for the year 2011, published in September 2012, provides insightful data on the prevalence of employer-sponsored healthcare plans among the total United States population of 312,250,315 citizens.

According to the report:

The number of individuals covered by health insurance saw an increase to 260.2 million (84.3%) in 2011, compared to 256.6 million (83.7%) in 2010.

The percentage of people covered by private health insurance in 2011 remained statistically unchanged from 2010, holding steady at 63.9%. This marks the first instance in the past decade where this rate has not experienced a decrease.

Employment-based health insurance coverage in 2011 remained stable at 55.1%, showing no significant change from the previous year.

Government health insurance coverage experienced a slight increase from 31.2% to 32.2%.

The percentage of individuals covered by Medicaid, the federal healthcare program for low-income families and individuals, rose from 15.8% in 2010 to 16.5% in 2011. Similarly, for Medicare, the federal healthcare program for the elderly, the percentage increased from 14.2% to 15.2%.

In 2011, 9.7% of children under the age of 19 (7.6 million) were without health insurance, a statistically unchanged figure from the 2010 estimate. Similar stability was observed for individuals aged 26 to 34 and those aged 45 to 64. However, a decline in the percentage of uninsured was noted for individuals aged 19 to 25, 35 to 44, and those aged 65 and older.

The uninsured rates in 2011 exhibited a downward trend with increasing household income, dropping from 25.4% for households with an annual income below $25,000 to 7.8% for households with an annual income of $75,000 or more.

*The presented estimate is statistically distinct from the estimate for the previous year (p<.05).

Note: As outlined in the Survey Design and Methods section, the estimates featured in this exhibit are derived from both the sample of firms that completed the entire survey and those that responded to a single question regarding the provision of health benefits.

The Structure of Healthcare Benefit Plans

The management and administration of reimbursement processes for medical expenses can be orchestrated by various entities, such as governmental agencies, private businesses, or nonprofit organizations. Healthcare financial protection, encompassing the reimbursement of incurred expenses, is often channeled through diverse avenues, including insurance companies, health maintenance organizations (HMOs), preferred provider organizations (PPOs), Blue Cross, and Blue Shield. These programs have transitioned from associations to licensed insurance offerings, a transformation explored in greater detail later in this chapter.

A company sponsoring a healthcare program may directly cover expenses on behalf of employees and their dependents through a self-insured plan. The scope of covered expenses can range from specific medical categories to comprehensive coverage encompassing all types of expenses.

Empirical evidence underscores that, among the array of functional benefits embedded in an employment contract, healthcare benefits are overwhelmingly deemed the most significant by workers. As the costs of medical care escalate, the importance of healthcare benefits to employees intensifies. This heightened significance arises from the potentially ruinous financial impact of medical costs, particularly those associated with major medical procedures, in the absence of company-sponsored healthcare benefits. Individuals often find themselves on the brink of bankruptcy when grappling with the financial burden of unexpected and catastrophic medical incidents.

Crucially, employer-sponsored healthcare benefit plans are undergoing substantive structural changes. A healthcare benefit study conducted in 2012 by the management consulting firm Oliver Wyman illuminated a major conundrum faced by companies. With the enactment of healthcare reform legislation (the Patient Care and Affordable Care Act of 2010), companies express a strong commitment to safeguarding their employees through company-sponsored healthcare programs. Simultaneously, these companies acknowledge that the long-term sustainability of providing such healthcare is in question. Employers find themselves at a crossroads, navigating a delicate balance between upholding their commitment to employee well-being and grappling with the escalating costs. The coming years will be pivotal as the tangible impact of the Affordable Care Act unfolds.

Healthcare Benefit Plan Design Considerations

The concept of healthcare benefits has undergone a transformative journey through the years. In the contemporary landscape, healthcare benefits encompass a broad spectrum, ranging from doctor charges—including associated tests and procedures—to hospitalization, dental care, and vision-related expenses. Beyond the traditional scope, healthcare benefits also extend to cover lost income, wellness-related costs, expenses related to addiction suppression, and various other facets of healthcare expenditure.

For the purposes of our discussion, we specifically define healthcare benefits as inclusive of medical expenses, dental costs, and vision-care expenditures.

The design of healthcare benefit plans is intricately shaped by a myriad of factors and features. Notably, recent decisions in plan design reflect a concerted effort to grapple with the imperative of managing escalating costs. Key considerations in this regard include:

Deductibles

Co-insurance

Copayments

Exclusions and limitations

Maximum benefits

Preadmission testing

Second surgical opinions

Coordination of benefits

These elements collectively contribute to shaping the contours of healthcare benefit plans, illustrating the dynamic interplay between evolving healthcare needs and the imperative of cost containment.

The People that Pay

In the United States, while public health insurance is a relatively recent phenomenon, the landscape of healthcare has long been dominated by private insurance entities. Commercial insurance has played a substantial role in providing healthcare benefits, with casualty and life insurance companies extending their services to encompass the healthcare sector.

Prominent examples of commercial insurance companies in this realm include Aetna, Humana, and United Health Group, typically offering group insurance coverage. Traditionally, healthcare benefits have been structured through a mechanism known as an indemnity plan, also referred to as a fee-for-service plan. Under this arrangement, employees have the flexibility to choose any medical provider, be it a doctor or hospital. Further insights into this concept are detailed in Chapter 3, "Healthcare Benefit Financing."

To enhance the integration of healthcare services and insurance, insurers have pioneered managed-care organizations. These entities, often created by insurers with their own provider networks or through contractual arrangements with other providers, seek to streamline healthcare delivery and insurance within a unified framework. The most prevalent form of managed-care organization is the health maintenance organization (HMO), whose development was incentivized by the Federal Health Maintenance Act of 1973.

This legislation facilitated the growth of HMOs by providing grants and loans for their establishment, expansion, or initiation. It also relaxed certain state restrictions for federally qualified HMOs, mandating employers with 25 or more employees to offer federally certified HMO options alongside traditional health insurance, without, however, compelling the provision of health insurance.

Fundamentally, HMOs aim to control costs and ensure effective healthcare by constraining patients to specific providers. This control is exerted through a provider panel mechanism and the involvement of primary care physicians who must authorize specialized care and referrals; bypassing this review process may result in non-payment of benefits.

While HMOs proliferated in the 1980s and 1990s, they faced declining popularity among employees due to the restrictions imposed on their healthcare choices. Responding to this shift, insurers introduced an alternative model known as a preferred provider organization (PPO). PPOs, in contrast to HMOs, do not mandate participants to use specific providers but incentivize such choices through reduced prices offered by network providers. Additionally, PPOs often do not necessitate participants to undergo primary care physician reviews, providing a more flexible approach to healthcare access.

Both Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs) have spearheaded the era of managed care, representing a paradigm shift in healthcare administration. Broadly, these plans and organizations are designed to exert control over the decision-making process, aiming to effectively manage medical expenses. Five key characteristics typify these managed care arrangements:

Controlled Access to Providers:

Managed care plans regulate and manage access to healthcare providers, steering participants toward specified networks of doctors, hospitals, and other healthcare professionals.

Comprehensive Utilization Management:

These plans engage in comprehensive utilization management, scrutinizing and optimizing the use of healthcare services. This involves assessing the necessity and efficiency of medical treatments and procedures.

Encouragement of Preventive Care:

Emphasizing a proactive approach to healthcare, managed care plans actively encourage preventive care measures. Participants are often incentivized to undergo regular check-ups, screenings, and vaccinations to mitigate potential health risks.

Facilitation of Risk Sharing Among Providers:

Managed care arrangements promote a collaborative approach among healthcare providers by facilitating risk-sharing mechanisms. This involves distributing and managing financial risks among the provider community to achieve cost-effective healthcare delivery.

Ensuring Quality Healthcare Delivery:

Quality assurance is a cornerstone of managed care plans. These organizations implement measures to ensure the delivery of high-quality healthcare services, encompassing standards for medical practices, patient outcomes, and overall healthcare effectiveness.

In essence, the guiding principles of managed care, as embodied by HMOs and PPOs, seek to optimize the healthcare system by aligning incentives, promoting preventative measures, and enhancing the overall quality and efficiency of healthcare delivery.

Payment Options

Healthcare programs employ two primary payment methods: fee-for-service and capitation. Within fee-for-service programs, three distinct methods are prevalent:

Cost-Based Reimbursement:

In this method, the payer agrees to cover the costs incurred in delivering services to the insured. Cost-based reimbursement is confined to allowable costs, typically encompassing expenses directly associated with providing healthcare services.

Charge-Based Reimbursement:

Payers are billed for services based on a predetermined rate schedule. Payments are commonly made on negotiated, discounted charges. Managed-care plans, leveraging their substantial member groups, wield the bargaining power to secure these discounts, which can range from 10% to 50% or more on stated charges.

Prospective Payments:

Rates in this system are established before services are rendered and are unrelated to costs or charges. Common units of payment include per procedure, per day, or a comprehensive global reimbursement process. In the latter, a single payment covers all services associated with a particular treatment or medical intervention.

In contrast, capitation represents a distinct payment paradigm. Under capitation, providers receive a fixed amount per covered life within a specified period, typically monthly, regardless of the actual services rendered. The reimbursement is determined based on the number of participants assigned to the provider, resulting in a fixed payment structure anchored in population coverage. This approach fundamentally shifts the reimbursement model from a service-centric perspective to one grounded in the overall population served.

Consumer-Driven Healthcare

Numerous organizations are embracing an alternative approach to healthcare through the adoption of Consumer-Driven Health Plans (CDHPs). At the core of these programs is a philosophy that actively engages consumers to directly influence and contain healthcare costs. The underlying principle is rooted in the belief that individuals, armed with proper information, tools, and financial incentives, can become more discerning and responsible healthcare consumers. A CDHP, therefore, empowers consumers with a sense of personal responsibility to facilitate this shift.

Typically, a CDHP incorporates a high deductible paired with an individually controlled healthcare account, featuring either a Health Savings Account (HSA) or a Health Reimbursement Account (HRA). These intricacies are expounded upon later in this chapter. The combination of a high-deductible plan and one of these account options aims to instill and encourage responsible behavior on the part of the consumer. These plans go beyond mere coverage by providing essential information and tools that enable informed decision-making.

Key components integral to a CDHP include:

• High-Deductible Health Plan:

The cornerstone of a CDHP involves a high-deductible health plan, creating a financial threshold that encourages consumers to be judicious in their healthcare choices.

• Individual Health Account:

An individually managed health account, housing either an HSA or HRA, serves as a financial reservoir to cover expenses not met by the plan. These accounts provide a personalized approach to managing healthcare costs.

• Information and Tools:

CDHPs emphasize the provision of comprehensive information and tools to empower participants in making well-informed decisions regarding their healthcare.

• Communication Program:

A robust communication program is developed to guide participants through decision-making processes, ensuring clarity and understanding of the intricacies of the CDHP.

• Healthcare Coach or Consultant:

Access to a healthcare coach or consultant further enhances the support structure, aiding participants in navigating the complexities of healthcare choices and strategies.

• Severe Chronic Illness Management:

Specialized programs for managing severe chronic illnesses, facilitated by licensed medical practitioners, are integrated into CDHPs, demonstrating a commitment to holistic healthcare management.

In essence, CDHPs embody a paradigm that not only transforms the financial dynamics of healthcare but also seeks to foster a culture of informed decision-making and responsible consumer behavior.

It's crucial to note that consumer-driven healthcare represents a relatively recent and innovative design feature. Generally, this initiative adopts one of two approaches. The first approach is commonly referred to as a defined contribution medical expense plan. Under this model, employers offer various options such as HMOs, PPOs, or an indemnity plan. The employer's contribution is set at the level of the lowest-cost item, often the HMO plan. If employees opt for a more expensive (and typically better) option, they are required to pay a higher out-of-pocket premium, constituting a high-deductible healthcare plan (HDHP).

In this scenario, the employer contributes a portion of the deductible. For instance, if the plan's deductible is $6,000, the employer might contribute $3,000. Should the employee choose this plan, a dedicated savings account is established, into which contributions are deposited. Funds from this account can be withdrawn for medical expenses, with the flexibility to roll over unused funds to the following year.

These plans are strategically designed to incentivize wise decision-making in seeking medical care services, as any expenditures exceeding the funds in the savings account must be fully covered by the employee.

High-deductible plans present a notable reduction in the overall cost of providing healthcare benefits. Furthermore, many employers view these plans as highly effective in transforming employees into informed consumers of expensive healthcare services. Notably, since 1996, employer contributions to the savings plan have been non-taxable for employees, adding a significant financial benefit to this consumer-driven healthcare approach.

To ensure the effectiveness of such a plan, the key focus should be on educating employees about medical needs, costs, and outcomes. With both their employers' contributions and their own funds deposited into the account, employees are incentivized to make informed decisions—essentially, to shop around for the most economical and cost-effective medical services.

In the second approach to consumer-driven healthcare, employees retain control over directing their expenditures using funds they specifically set aside for these purposes. When individuals spend their own money, a strong incentive is created to be responsible when purchasing healthcare, fostering self-imposed cost-containment measures.

This second approach leverages various government-supported, tax-favored incentives and programs, including:

• HSAs (Health Savings Accounts):

These accounts allow individuals to save money tax-free for qualified medical expenses. The funds contributed to an HSA roll over from year to year, offering a long-term approach to managing healthcare costs.

• HRAs (Health Reimbursement Accounts):

HRAs provide employers with the flexibility to reimburse employees for eligible medical expenses. Unlike HSAs, HRAs are solely funded by the employer, offering a tax-advantaged benefit to employees.

• FSAs (Flexible Spending Accounts):

While not precisely classified as consumer-driven, FSAs operate as a pre tax spending provision. Employees contribute to an FSA with pretax dollars, which can be used for eligible medical expenses during the plan year.

Accounting Implications and Issues Affecting Healthcare Benefit Plans

This section delves into the intricacies of healthcare plan design, exploring the technical dimensions that span accounting, tax implications, legal considerations, financial aspects, and auditing requirements.

The Standards Framework

In the United States, the accounting of health and welfare programs is shaped by two pivotal guiding principles, as established by the generally accepted accounting principles (GAAP), the Financial Accounting Standards Board (FASB), and the Employee Retirement Security Act (ERISA). On the international front, the corresponding principle is the International Financial Reporting Standards (IFRS).

Under the U.S. GAAP, the accounting for health and welfare plans is outlined in FASB Accounting Standards Codification (ASC) Regulation 965, while IFRS codification is addressed in IAS 19.

Throughout this section, our discussion is anchored in these rules, regulations, and principles, specifically under the U.S. GAAP (FAS 965) and the IFRS (IAS 19). You will gain insights into the essential elements of accounting requirements as prescribed by these relevant codes.

Companies in the United States have been diligently examining the distinctions between the International Financial Reporting Standards (IFRS) and the U.S. Generally Accepted Accounting Principles (GAAP) in anticipation of a potential convergence of standards. The industry is on standby, awaiting any forthcoming mandates from rule-making bodies that might require U.S. companies to adopt IFRS standards.

Conducting a comprehensive analysis, interpretation, and understanding of Financial Accounting Standards Board (FASB) standards, particularly in the context of benefits accounting, is a valuable undertaking. Simultaneously, a similar analysis must be applied to IFRS standards, given the prospect of convergence in the near future.

A robust understanding of the accounting principles under both sets of standards will prove instrumental in facilitating a smooth convergence process, should it be mandated. Later in this chapter, the discussion delves into IFRS regulations related to health and welfare, offering a comprehensive exploration of these international standards.

It's important to note that the ongoing discussion is rooted in a direct analysis and comprehensive examination of these standards, providing a foundational understanding for navigating the potential convergence landscape.

Defined Contribution Versus Defined Benefit Plans

Defined contribution health and welfare plans stand apart from defined benefit plans through their distinct operational mechanisms. In a defined contribution plan, meticulous records are maintained for each participant's account, detailing contributions made by both participants and their employers. This comprehensive record-keeping extends to encompass various elements, including flexible spending arrangements, vacation plans, and Health Savings Accounts (HSAs).

Contrastingly, a defined benefit plan outlines a specific benefit, which may take the form of reimbursement to the covered participant or direct payments to providers or third-party insurers for stipulated services. Participants in defined benefit plans receive a predetermined benefit determined by a formula stipulated within the plans themselves. In contrast, defined contribution plans furnish benefits based on the cumulative amounts contributed to individual participant accounts. The key distinction lies in the method of benefit determination, with defined benefit plans specifying the outcome, while defined contribution plans derive benefits from accumulated contributions.

In the context of defined benefit plans, several components contribute to their financial dynamics, each holding inherent value. These include:

• Forfeitures:

Forfeitures represent a component that contributes to the overall value of the defined benefit plan. These are assets that were once allocated to a participant but are subsequently relinquished, typically due to factors like the participant leaving the plan before full vesting.

• Investment Experience:

The investment experience is a critical factor influencing the financial health of a defined benefit plan. It encompasses the returns and performance of the plan's investments, exerting a direct impact on the overall value and sustainability of the plan.

• Administrative Expenses:

Administrative expenses constitute a vital element in the financial makeup of defined benefit plans. These expenses cover the costs associated with managing and maintaining the plan, ensuring its smooth operation and compliance with regulatory requirements.

Given the intrinsic value associated with each of these components, the financial statements of a defined benefit plan play a pivotal role in offering insights into its current and future capacity to meet benefit obligations as they become due. To fulfill this mandate, the plan's financial statements should present comprehensive information about its assets and benefit obligations, the outcomes of transactions or events affecting its assets and liabilities, and any other pertinent details essential for stakeholders to analyze the information presented.

It is imperative that different types of defined benefit plans, whether multiemployer or single employer, distinctly report benefit obligations, encompassing those related to post-retirement scenarios. This separation aids in providing a clear and transparent representation of the plan's financial standing and commitments.

Section 965 Explained

• Benefit Payments (965-30-25-1):

Health and welfare plans manage benefit payments either directly or through the utilization of a third-party administrator (TPA) in an administrative service arrangement (ASA). Benefit payments are processed by fully or partially self-funded plans, highlighting the versatility in plan structures.

• Premiums Due Under Insurance Arrangements (965-30-25-3):

Unpaid premiums due under insurance arrangements should be integral to the accounting for any obligation. Recognizing the pending premium payments is essential for an accurate representation of the plan's financial standing.

• Post-Employment Benefits (965-30-25-3):

For post-employment benefits, a benefit obligation must be recognized for current employees based on future payment amounts, subject to specific conditions. These conditions encompass the employee's right being tied to services rendered, vested benefits, a high probability of payment, and accurate estimation. An exception exists for plans offering uniform benefits due to an event like medical benefits under a disability plan, which typically lacks a vesting provision.

Disability benefits must be accrued from the disability's onset (965-30-25-4).

• Obligations for Premium Deficits (965-30-25-5):

Fully insured experience-rated plans may incur deficits based on experience ratings determined by insurance companies. These deficits must be incorporated into the total benefit obligation if certain criteria are met, including the probability of applying the deficit against future premiums or experience-rated refunds.

• Recognition of Employer Contributions (965-310-25-1):

If an employer formally commits to contributions, documentation is imperative. Sufficient evidence may include a governing body resolution, a consistent payment pattern under a funding policy, proof of federal tax deductions, and an accounting recognition as a current liability. Mere accruals or liability amounts exceeding plan assets are deemed insufficient for recognition.

This nuanced breakdown ensures a comprehensive understanding of the various components and considerations in the accounting landscape of health and welfare plans.

• Recognition of Premiums Paid to Insurance Companies (965-310-25-2):

The recognition of premiums paid to insurance companies hinges on whether the payments serve as a transfer of risk or function as a deposit. A meticulous analysis is necessary to determine the extent of risk transfer. Insurance companies might mandate a deposit for potential losses, and these deposits are considered plan assets until applied to premiums. In cases where reserves are forfeitable upon termination of the insurance contract, this factor must be factored into asset calculations. If experience-rated premium refunds are anticipated, and if the policy year doesn't align with the plan, expected refunds should also be documented as plan assets. It is assumed that all calculations can be reasonably performed, per 965-310-25-3.

• Calculating Plan Benefit Obligations (965-30-35-1):

The calculation of benefit obligations for single/multiemployer defined health and welfare plans necessitates the inclusion of the actuarial present value of various elements:

Claims Payable:

The present value of claims that are currently payable.

Claims Incurred But Not Reported (IBNR):

The present value of claims that have been incurred but not yet reported.

Premiums Due to Insurance Companies:

Premiums due for accumulated credits and postemployment benefits. This encompasses premiums for retired participants, including beneficiaries and dependents, as well as other eligible participants and those not yet fully eligible. This crucial information should be integrated into the body of financial reports rather than relegated to footnote disclosures.

Claims Incurred But Not Reported

A crucial concept impacting both the actuarial valuations of plan assets and liabilities is IBNR (claims incurred but not reported). An IBNR claim represents healthcare services that have been provided but remain unrecorded or unprocessed by the healthcare provider, clinic, hospital, or any other health service organization. Typically, IBNRs are integral to risk-adjusted contracts between managed-care organizations and healthcare providers. In essence, an IBNR claim denotes the estimated cost of medical services for which a formal claim has not yet been filed. Efficient monitoring of these claims is typically facilitated through an IBNR collection system or control sheet. This concept plays a pivotal role in accurately assessing the financial landscape of health and welfare plans, ensuring comprehensive consideration of both reported and unreported liabilities.

In a more formal context, IBNR (claims incurred but not reported) represents the financial accounting of all services that have been performed but, due to a time element or "lag," have not been invoiced or recorded as of a specific date. The proper accounting for transactions covering provided medical services involves the following accrued but not reported IBNR entry:

• Debit—Accrued Payments to Medical Providers or Healthcare Entity

• Credit—IBNR Accrual Account

For instance, consider a scenario in a hospital where a coronary artery bypass surgery is performed for a managed care plan member. The surgeon or healthcare organization incurs expenses for related services, such as therapy, rehabilitation, drugs, and durable medical equipment, from a future payment fund. These payments constitute contractual obligations, representing a liability.

However, the health plan may not receive the complete billing until several weeks, months, or quarters later, possibly even further downstream in the reporting year post-patient discharge. To accurately project the health plan's financial liability, both the health plan and the hospital must estimate the cost of care based on historical expenses.

Given the paramount importance of identifying and controlling costs in financial healthcare management, an IBNR reserve fund (an interest-bearing account) is established for claims reflecting services already delivered but not recorded or reimbursed by a specified deadline.

From an accounting perspective, the IBNR needs to be accrued as an expense and a short-term liability for each fiscal month or accounting period. This ensures that the organization remains financially capable of fulfilling the associated claims even if the corresponding revenue has already been expended. Properly managing these "bills in the pipeline" is crucial for proactive providers and health organizations. IBNRs gain particular significance with newer patients who may present with higher medical needs than historical norms.

Amounts that hospitals anticipate recovering (recoverables) are incorporated into their reserve charges. In many instances, these recoverables may eventually transition into IBNR losses, recorded as IBNR claims on the balance sheet. As these book losses transform into actual losses, hospitals may seek reimbursement from insurers, a process that could involve disputes over the charges.

For self-funded plans, the measurement of IBNR cost is a critical process that involves assessing the present value of the plan's estimated ultimate cost for settling claims. The estimated ultimate costs should encapsulate the plan's responsibility to pay claims to or for participants, extending beyond the financial statement date if specified, and encompassing considerations such as continuing health coverage or long-term disability. This approach, outlined in 965-30-35-1A, ensures a comprehensive evaluation that reflects the plan's obligations, irrespective of participants' employment status, providing a robust foundation for financial reporting.

Other Benefit Obligations

Administrative Expenses Recognition (965-30-35-2):

Administrative expenses incurred by the plan can be appropriately recognized by either incorporating the estimated administrative expenses into the benefits expected to be paid or by adjusting the discount rate. This flexible approach, as outlined in 965-30-35-2, ensures a comprehensive reflection of administrative costs in the overall financial considerations of the plan.

Measurement of Postretirement Benefit Obligation (965-30-35-2):

The postretirement benefit obligation should be meticulously measured as the actuarial present value of future benefits linked to the participant's service performed as of the cost measurement date. The calculation, reduced by projected future contributions from plan participants, serves as the employer's funding requirement and the accumulated plan assets. Key considerations in this calculation include the continuity of the plan, the assurance that assumptions about future events will be met, accounting for anticipated forfeitures, and integration with other plans. The discount rate utilized should align with the rate of return matching high-quality fixed income investments.

Calculation of Insurance Premiums for Plan Participants (965-30-35-9):

The insurance premiums paid for plan participants who have accrued sufficient eligibility credits or hours of employment should be determined by multiplying eligibility credits by the current insurance premium. For self-funded plans, the calculation involves using the average of all benefits per eligible participant. Mortality rates, expected employee turnover, and other necessary assumptions must be factored into this calculation for accuracy.

Additional Premiums Due to Exceeding Loss Ratio (965-30-35-9):

Any additional premiums resulting from the loss ratio exceeding a specified percentage should be duly considered. This ensures that the financial impact of surpassing the expected loss ratio is appropriately reflected in the overall financial framework of the plan.

Additional Payments to Insurance Companies under Stop-Loss Arrangements (965-30-35-12):

Provision for additional payments to insurance companies arising from stop-loss arrangements is vital. This entails recognizing and accounting for any extra payments triggered by the stop-loss provisions, emphasizing the need for comprehensive financial planning and risk management.

These nuanced considerations, as delineated in the specific accounting standards, contribute to a robust financial management approach for health and welfare plans.

Additional Obligations for Postretirement Health Plans

In accounting for benefits provided as part of a postretirement health plan, the estimation of payments to participants is a crucial aspect of financial management. Typically commencing either on the retirement date or at a specified age, the calculation of the estimated obligation as of a given date relies on the actuarial present value of all future benefits attributable to the participant's period of employment. The covered individuals in benefit obligation calculations encompass:

• Retirees

• Terminated Employees (if benefits have been earned)

• Beneficiaries (or covered dependents)

• Active Employees, Their Beneficiaries, and Covered Dependents

The thoroughness of benefit obligation calculations demands consideration of the following assumptions and calculation elements:

• Appropriate Discount Rates: Reflecting the time value of money to ensure accurate present value assessment.

• Per Capita Cost of Claims by Age: Recognizing variations in healthcare costs across different age groups.

• Healthcare Cost Trends: Incorporating anticipated changes in healthcare costs over time.

• Medicare Reimbursement Rates: Considering the impact of Medicare reimbursement on overall benefit obligations.

• Retirement Age: Accounting for variations in retirement age among participants.

• Dependency Status: Differentiating benefits based on the dependency status of participants.

• Mortality: Factoring in mortality rates for precise estimations.

• Salary Progression: Accounting for changes in salary over the course of employment.

• Probability of Payment Calculation: Evaluating the likelihood of actual payment of benefits.

• Participation Rates: Considering the rates at which individuals participate in the benefit plan.

These comprehensive considerations and calculations ensure that the estimation of benefit obligations aligns with the dynamic nature of postretirement health plans and provides a solid foundation for financial reporting and planning.

Benefit obligations, as calculated for postretirement health plans, should explicitly exclude death benefits that may become payable during employees' active service periods. The determination of this benefit obligation typically involves applying current insurance premium rates or, in the case of a self-funded plan, the average cost of benefits per eligible employee. The calculation is intricately linked to assumptions regarding mortality rates and the probability of employee turnover, ensuring a comprehensive and realistic assessment of future obligations.

(Refer to 965-30-35-15 to 22 for detailed guidance on these exclusions and the calculation methodology.)

Fair Value Measurement

Fair value, within the context of healthcare benefits, is a pivotal concept that denotes "the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date" (FASB ASC 820-10-20). This definition, provided by the Financial Accounting Standards Board (FASB) ASC 820, not only outlines fair value but also establishes a comprehensive framework for its measurement and mandates specific disclosure requirements.

To fulfill these requirements, a collaborative effort among management, custodians, investment fiduciaries, and plan auditors is indispensable. Sponsors and administrators bear the responsibility of ensuring the implementation of a robust valuation process, the availability of accurate data for fair value determination, adherence to the prescribed measuring framework, and inclusion of requisite disclosures.

A condensed overview of FASB ASC 820 is presented below:

Noncash Contributions: Contributions in noncash form must be recorded at fair value (FASB ASC 965-20-30-1). In case of a subsequent sale, the sale value is determined as the fair value minus the cost.

Financial Statements Presentation: Statements for the plan must present total assets, liabilities, net assets available for benefits, and net assets reflecting investments at fair value (FASB ASC 965-20-45-1). All associated accounting for these assets reflecting investments should ensure their presentation at fair value (FASB ASC 965-20-45-2-5).

Unusual or Infrequent Statements: Disclosures are required for unusual or infrequent events or transactions occurring after the financial statement date if they significantly impact the financial statements. A notable change in the fair value of plan assets is a mandatory disclosure event (FASB ASC 965-20-50-1).

Investments Recording: Equity, debt securities, real estate, or other investments must be recorded at their fair value as of the financial statements date (FASB ASC 965-320-35-1 / FASB ASC 965-325-35-1).

Net Appreciation or Depreciation Disclosure: The notes for financial statements must disclose the net appreciation or depreciation of the investments' fair value (FASB 965-320-50-1).

Insurance Contracts: As per the Employee Retirement Income Security Act, insurance contracts should be presented at fair value or at the amount determined by the insurance company (e.g., contract value) (FASB ASC 965-325-35-3).

In essence, compliance with FASB ASC 820 is essential for transparent and accurate reporting of fair value in healthcare benefit plans, requiring a thorough understanding and collaboration among various stakeholders to ensure effective implementation and disclosure.

Financial Statements of Defined Benefit/Contribution Plans

The primary objective of crafting a financial statement for a defined benefit health and welfare plan or a defined contribution plan is to furnish pertinent financial information for assessing the plan's current and future capacity to meet its benefit obligations in a timely manner. This necessitates the inclusion of comprehensive details about plan resources, benefit obligations, as well as transactions and events pertaining to the plan within the financial statement. Supplementary information that enhances the comprehension of this financial data may also be incorporated.

For defined benefit plans, adherence to an accrual basis of accounting is imperative. The financial statement for such a plan should encompass a statement of net assets available for the year's benefits, presenting crucial information concerning investments, insurance contracts, and investment contacts. Additionally, a statement of changes in these assets is essential, highlighting significant alterations occurring throughout the designated year.

These changes encompass:

Contributions

Fluctuations in the value of investments and associated income

Modifications in income taxes, whether paid or payable

Adjustments in payments for claims and premiums

Alterations in operating and administrative expenses

In the event of adjustments to employer contributions, a meticulous separation of cash and noncash components is imperative. Noncash contributions must be elucidated in a note outlining their nature. Further considerations concerning alterations to contributions, including those from other identified sources such as state subsidies or federal grants, need to be addressed, whether related to employees or collected and remitted. This meticulous detailing ensures a comprehensive and transparent representation of the plan's financial dynamics, fostering a more insightful evaluation of its ability to meet benefit obligations both currently and in the future.

Concerning changes in investment value, whether resulting in net depreciation or appreciation, it is imperative to address them distinctly based on the measurements of the investment's fair value. The determination of fair value involves ascertaining whether the value is derived from a quoted price in an active market or through another method.

It is crucial to note that changes in the payment for a claim exclude alterations to contracts made by the insurance company, as these are not considered part of plan assets.

The third element incorporated into the financial statement of a defined benefit plan pertains to information about the plan's obligations throughout the year.

Furthermore, the ultimate inclusion in the financial statement for a defined benefit plan encompasses details regarding the impact of changes in the plan's obligations. All factors instigating these changes over the plan's duration must be meticulously identified. This encompasses amendments, alterations in the nature of the plan, and modifications in actuarial assumptions, constituting the minimum disclosures concerning changes in benefit obligations.

Certain defined contribution plans impose balance limitations on participants' accounts, such as vacation plans, holiday plans, and legal plans (FASB ASC 965-205-10-1-2). The requisite financial information encompasses details about plan resources, their functioning, management, and the outcomes of transactions and events influencing these resources, along with other factors enhancing the comprehension of the provided information. Essential components include a statement of net assets available for plan benefits throughout the year and the statement of changes in net assets. This ensures a comprehensive and transparent representation of the plan's financial dynamics and aids in evaluating its performance and impact on participant accounts.

Self-Funding of Healthcare Benefits

A pivotal financial consideration in the realm of benefit programs revolves around the concept of self-funding. In this approach, rather than procuring a pre-packaged insurance product, an employer allocates funds directly from the company's general resources to finance an employee's plan.

The landscape of healthcare costs has witnessed a consistent upward trajectory over numerous years, prompting employers to actively explore avenues for cost mitigation. Self-insured health plans emerge as a strategic solution in this context. These plans empower companies to settle submitted claims through a dynamic pay-as-you-go system, offering a flexible and cost-effective alternative. The intricacies of self-funding will be thoroughly examined and elucidated in Chapter 3, providing a comprehensive understanding of its mechanisms and advantages in navigating the evolving landscape of employee benefit programs.

Tax Dimensions of Healthcare Plans

As outlined earlier in this chapter, the Internal Revenue Service (IRS) tax codes have introduced specific healthcare initiatives. This section delves into a detailed exploration of these initiatives.

Health Savings Accounts

Established in 2003 under the Medicare Prescription Drug Improvement and Modernization Act, Health Savings Accounts (HSAs) provide a tax-advantaged avenue for individuals covered by high-deductible health plans (HDHP) to manage funds earmarked for medical expenses. Typically associated with lower premiums but higher deductibles than traditional health plans, HDHPs are designed for specific, catastrophic health events.

According to a survey conducted by the Kaiser Family Foundation in September 2008, the adoption of Consumer-Driven Health Plans (CDHP), including both HSAs and Health Reimbursement Arrangements (HRAs), witnessed a notable increase from 4% in 2006 to 8% among covered workers. Correspondingly, approximately 10% of firms offered such plans. The majority of HSA plans appeared to be employer-sponsored, with around 25% individually set up, as corroborated by a study from America’s Health Insurance Plans (AHIP), reporting a total of 6.1 million Americans covered by HSA plans as of January 2008.

An overarching trend in HSA data reveals that contributions to these plans consistently outpace withdrawals, often nearly doubling in magnitude since their inception.

Contributions to HSAs can be made by individual members of an HSA-eligible HDHP, employers, or other parties. Employer contributions subject the plan to ERISA-qualified status, activating nondiscrimination rules unless contributions are channeled through a Section 125 plan, where such rules do not apply. Employers enjoy flexibility in distribution, allowing distinctions between full-time and part-time employees, as well as variations between individual and family participants.

Contributions, whether from an employer or employee, may occur on a pretax basis, offering the advantage of avoiding FICA and Medicare tax deductions, translating to a significant 7.65% savings for both parties, within Social Security wage base limits. In the absence of employer contributions, post-tax deposits can still be utilized to reduce gross taxable income in the subsequent year. It is imperative to note that contributions are restricted to those covered under an HSA-eligible HDHP, maintaining the integrity of the account's purpose and benefits.

Initially, the annual maximum deposit to a Health Savings Account (HSA) fell below the actual deductible or specified IRS limits. However, Congress subsequently eliminated this limit tied to the deductible and established maximum contribution limits. All contributions to an HSA, regardless of their origin, contribute to an annual maximum. Additionally, a catch-up provision exists for participants aged 55 and over, allowing an increased IRS limit.

Notably, all deposits to an HSA become the sole property of the policyholder, irrespective of their source. Unwithdrawn funds roll over from year to year, providing a sustained financial reservoir. In the event that a policyholder discontinues their HSA-eligible insurance coverage, further deposits are prohibited; however, existing funds in the HSA remain accessible for use.

The Tax Relief and Health Care Act, enacted on December 20, 2006, introduced a significant provision permitting a one-time rollover of Individual Retirement Account (IRA) assets to fund up to a year's maximum HSA contribution. State tax treatment of HSAs exhibits variability.

According to IRS Publication 969: Health Savings and Other Tax-Favored Health Plans, an individual can generally make HSA contributions for a given tax year until the deadline for filing returns, typically on April 15.

For the years 2012 and 2013, the IRS stipulated contributions as follows:

Funds within a Health Savings Account (HSA) can be strategically invested, employing a methodology akin to Individual Retirement Accounts (IRAs). Notably, investment earnings enjoy tax-sheltered status until the moment of withdrawal.

While HSA funds are transferrable to other HSAs, it's crucial to note that rollovers into an IRA or a 401(k) are not permissible. Similarly, funds from IRAs and alternative investments cannot be seamlessly rolled into an HSA, with the exception of the previously mentioned one-time IRA transfer.

In a departure from some employer contributions to plans like a 401(k), all contributions to an HSA immediately become the property of the participant, irrespective of their origin. Unlike certain other accounts, HSA participants are not obligated to secure advance approval from their trustee or medical insurer to withdraw funds. Importantly, funds used for qualified expenses, encompassing services and items covered by the health plan subject to cost-sharing such as deductibles and co-insurance, remain exempt from income tax. Withdrawals can also be made for expenses beyond medical plans coverage, including dental, vision, chiropractic care, medical equipment like eyeglasses and hearing aids, and transportation expenses related to medical care. Until December 31, 2010, even nonprescription over-the-counter medications were eligible for HSA funds.

However, the landscape changed on January 1, 2011, with the implementation of the Patient Protection and Affordable Care Act, commonly known as Healthcare Reform. This legislation stipulates that HSA funds can no longer be utilized to purchase over-the-counter drugs without a doctor's prescription, highlighting the evolving regulatory environment surrounding HSA usage.

Health Savings Account (HSA) funds offer flexibility in withdrawal methods, allowing account holders to access funds through various means such as debit cards or personal checks. Withdrawals can be initiated for any reason, but it's crucial to note that withdrawals not allocated to documented and qualified medical expenses are subject to income tax and a 20% penalty. This penalty is exempt for individuals aged 65 or older or those with disabilities at the time of withdrawal. In such cases, only income tax is applicable, effectively rendering the account tax-deferred, similar to an Individual Retirement Account (IRA), with medical expenses continuing to enjoy tax-free status. Post-January 1, 2011, the penalty for nonqualified withdrawals, under the Patient Protection and Affordable Care Act, reduced to 10%.

To substantiate withdrawals, account holders must maintain proper documentation for their medical expenses. Neglecting this requirement may lead the IRS to classify expenses as unqualified, exposing the taxpayer to additional penalties.

An HSA plan represents an innovative approach designed primarily to mitigate healthcare costs for employers, thereby enhancing the efficiency of the healthcare system. The underlying principle is grounded in the belief that when individuals utilize their own funds, it fosters a sense of responsibility in healthcare decision-making, promoting cost-effective choices. Additionally, the model anticipates that individuals bearing their expenses will be more discerning in gathering information, actively seek lower-cost options, and remain vigilant against excess and fraud. Consequently, the HSA program serves as a valuable tool for containing costs in the healthcare sector.

Within the realm of Consumer-Driven Health Plans (CDHPs), two alternative plans share common objectives yet feature distinct structures: Health Reimbursement Arrangements (HRAs) and Flexible Spending Accounts (FSAs).

Health Reimbursement Accounts

Health Reimbursement Accounts (HRAs), also known as health reimbursement arrangements, are IRS-approved programs that empower employers to earmark funds for reimbursing medical expenses incurred by employees. These programs present tax advantages for both employees and employers.

Offered to both employees and retirees, this account enables participants to utilize the allocated funds for various medical expenses, including deductibles, co-insurance, and covered medical costs. Similar to Health Savings Accounts (HSAs), any unspent funds can be carried over from one year to the next, as long as the individual remains a member of the plan. Importantly, these contributions by the employer do not count as income, resulting in significant tax savings.

Employers establish and manage HRA programs, often leveraging third-party administrators. The flexibility of these plans allows participants to potentially roll over plan balances, with the employee deciding the rollover amount, either as a percentage or a fixed amount. According to IRS guidelines, HRAs must be exclusively funded by employers, and contributions cannot be facilitated through a voluntary salary reduction agreement. Notably, there is no cap on employer contributions, as these contributions are excluded from an employee's income.

As outlined in IRS Publication 96, participants in HRA programs are reimbursed tax-free for qualified medical expenses up to a maximum dollar amount for a defined coverage period. HRAs specifically reimburse items agreed upon by the employer, such as copays, co-insurance, deductibles, and services not covered by the company's standard insurance plan. Employers fund individual reimbursement accounts for their employees within the HRA framework and define the eligible uses of these funds.

Before a plan can be put into effect, qualified claims must be clearly outlined in a comprehensive plan document. Approved reimbursements may cover a spectrum of services, including medical and dental services, copays, co-insurance, and deductibles, although the specifics can vary from one plan to another. Importantly, employers are not obligated to prepay into a fund for reimbursements; instead, they have the flexibility to reimburse employee claims as they arise.

Reimbursements under an Health Reimbursement Account (HRA) plan extend to a broad scope, encompassing current and former employees, spouses, and any individual the employee may have claimed as a dependent on their tax return, with specific exceptions outlined in the plan.

A significant advantage of a plan like this lies in its ability to provide employers with predictability in their healthcare benefit expenses. This predictability contributes to effective cost containment, offering employers a clearer understanding and control over their healthcare-related expenditures for employees.

Flexible Spending Accounts

As mentioned earlier, Flexible Spending Accounts (FSAs) are not typically utilized as a cost-containment tool for employers. Instead, an FSA serves as a program designed to empower employees to efficiently allocate their own funds toward healthcare and dependent care expenses. In this arrangement, individuals can earmark a specific portion of their earnings to cover these expenses, and these funds are exempt from payroll taxes. However, a significant drawback of FSAs is that any unspent funds at the end of the year are forfeited, distinguishing them from Health Savings Account (HSA) funds, which can carry over.

The most prevalent type of FSA is designated for medical expenses. While HSAs and FSAs share similarities, the primary distinction lies in the fact that an HSA is a component of a consumer-driven plan, whereas an FSA can be integrated with either a consumer-driven plan or a traditional healthcare benefit plan. An FSA may comprise two components: one dedicated to qualified medical expenses and the other geared towards dependent care expenses.

Medical Expense FSA

The most prevalent form of Flexible Spending Account (FSA) is designed to cover medical expenses not covered by insurance, including deductibles, copayments, and co-insurance amounts. As of January 1, 2011, changes in regulations stipulated that over-the-counter medications are allowable only when acquired with a doctor's prescription, with insulin being the sole exception. Nevertheless, over-the-counter medical devices like bandages, crutches, and eyeglass repair kits remain permissible.

Prior to the implementation of the Patient Protection and Affordable Care Act, employers had the flexibility to establish any maximum for their employees. However, the enactment of this act brought about a modification in Section 125, restricting FSAs by capping employees' annual elections. This limit, set by the IRS, was initially established at $2,500 for the first plan year commencing after December 31, 2012. Subsequent plan years' limits are subject to adjustments based on cost-of-living considerations. Employers have the option to further limit their employees' annual elections. It is essential to note that this limit applies individually to each employee, regardless of marital status or dependents. Contributions not deducted from an employee's wages are not factored into this limit. In scenarios where an individual is employed by multiple unrelated employers, they are permitted to choose an amount up to the limit under each employer's separate plan. Importantly, this limit does not extend to Health Savings Accounts (HSAs), reimbursement arrangements, or the employee's share of the cost of employer-sponsored coverage.

Dependent Care FSA

Flexible Spending Accounts (FSAs) can also be established to cover expenses for an employee's dependents. Specifically, the dependent care FSA is subject to a federal cap of $5,000 annually per household. Married spouses have the option to each elect a separate FSA, but the combined total of their elections cannot exceed $5,000. Withdrawals surpassing the $5,000 threshold are subject to taxation.

In recent years, the introduction of the FSA debit card has streamlined direct access to the account for employees. This innovation has not only enhanced convenience but has also simplified the substantiation requirement, alleviating the need for labor-intensive claims processing.

However, a notable drawback of this system is that funds set aside must be utilized "within the coverage period," as defined by the specific coverage's parameters. Typically, this period aligns with the plan year, often designated as the calendar year. Any funds remaining unspent at the conclusion of this coverage period are forfeited.

These forfeited funds can be directed towards administrative costs or evenly distributed as taxable income among all participants. The coverage period concludes upon termination of employment, regardless of the initiator of this termination. The only exception to this rule is if the employee continues coverage with the company under COBRA or another stipulated arrangement.

International Financial Reporting Standards and Employee Health and Welfare Plans

Under the International Financial Reporting Standards (IFRS), accounting for employee benefits is governed by IAS 19. In this context, we focus on provisions related specifically to benefit items. It's important to note that IAS 19 also encompasses items termed employee compensation for the purposes of this discussion. Key provisions of IAS 19 within this domain include:

Short-term Benefits: These pertain to benefits payable within one year, contingent upon the employee providing the requisite services. This category covers medical benefits, vacation, and sick pay in the context of employee benefits. IAS 19 mandates that the undiscounted amount of these benefits is expected to be paid after the services have been rendered.

Post-employment Benefits: These are payable after the employment term concludes and encompass pensions, retiree health benefits, life insurance, and the continuation of medical and life benefits post-employment. This category excludes termination benefits. For defined contribution plans, IAS 19 stipulates that the recognized costs in the period are the contributions made in exchange for employee services during that period. In the case of defined benefit plans, the amount recognized in the balance sheet must equal the present value of the defined benefit obligation, adjusted for unrecognized actuarial gains or losses. Additionally, it includes unrecognized past service costs for pension plans. The balance is offset by the fair value of plan assets at the balance sheet's creation date.

Termination Benefits: These are payments made upon involuntary termination or voluntary termination where compensation has been granted for a temporary period. IAS 19 specifies that payable amounts should be recognized after the company decides to terminate an employee (or group of employees) before retirement or provide termination benefits due to an offer encouraging voluntary terminations.

IAS 19 necessitates that a company demonstrates planned termination within the terms of a formal, written plan, with no intention of canceling the plan post-termination. The standard also permits the discounting of action costs from the balance sheet after 12 months have elapsed, provided benefits are actively being paid.

Summary

This chapter delves into various aspects of healthcare benefit plans, offering insights into their historical evolution and shedding light on the contemporary changes propelled by shifts in healthcare policies. Employers' sponsored healthcare benefit plans are undergoing fundamental structural transformations, and the chapter addresses these changes while exploring crucial considerations in plan design, particularly emphasizing the pivotal factor of cost containment.

A notable addition to the landscape of healthcare benefit plans is the concept of consumer-driven healthcare, a relatively novel aspect discussed in the chapter. Two key consumer-driven approaches, namely defined contribution medical expense plans and consumer-driven healthcare plans, are thoroughly examined.

On the accounting front, the chapter elucidates the significance of ASC regulation 965 as the primary accounting rule governing healthcare plans in the United States, offering a succinct overview of the ASC 965 rules. On the global stage, the major international accounting rule for healthcare plans, IAS 19, is also outlined.

Self-funding emerges as a major financial consideration in healthcare plans, and the chapter provides a comprehensive example to elucidate the intricacies of self-funding a health plan.

Tax dimensions related to healthcare plans are also explored, with a focus on IRS tax code initiatives that introduce tax-favored healthcare options, including health savings accounts, health reimbursement accounts/arrangements, and flexible spending accounts.

In conclusion, the chapter encapsulates the International Financial Reporting Standards relevant to healthcare plans, providing a holistic perspective on the multifaceted dimensions of healthcare benefit programs.

Key Concepts in This Chapter

• Healthcare benefits

• Health maintenance organization (HMO)

• Preferred provider organizations (PPOs)

• Patient Care and Affordable Care Act 2010

• High-deductible healthcare plan (HDHP)

• Employee Retirement Security Act (ERISA)

• FASB ASC regulation 965

• IFRS codification IAS 19

• Defined contribution plans and defined benefit plans

• Claims incurred but not reported (IBNR)

• Health saving accounts (HSAs)

• Health reimbursement accounts (HRAs)

• Flexible spending accounts (FSAs)

Chapter 3 Healthcare Benefit Financing

Chapter Objectives:

Examine Healthcare Financing Challenges: Unpack the challenges inherent in healthcare financing, addressing the complex landscape influenced by factors such as escalating costs.

Explore Financing Approaches: Discuss various financing approaches employed in healthcare plans, providing insights into the diverse mechanisms used for fund allocation.

Understand ERISA and Self-Funded Plans: Elaborate on the intricate relationship between the Employee Retirement Income Security Act (ERISA) and self-funded healthcare plans, highlighting their interplay.

Illustrate with a Self-Funded Plan Example: Provide a comprehensive example elucidating the intricacies of a self-funded healthcare plan, offering practical insights.

Introduce Utilization Review: Explain the concept of utilization review, shedding light on its significance and role in healthcare financing.

Explore Value-Based Benefit Design: Introduce the concept of value-based benefit design, exploring innovative approaches that prioritize value in healthcare plans.

Concluding Thoughts on Healthcare Plan Financing: Summarize key insights and perspectives on healthcare plan financing, offering a reflective conclusion to the chapter.

Introduction:

Healthcare finance, encompassing the allocation and mechanisms of fund disbursement, is a critical aspect of the evolving landscape of employee healthcare benefits. This chapter delves into the transformative impact of escalating costs on healthcare benefit design, addressing the challenges faced in healthcare financing. The magnitude of these challenges is underscored by key data points:

In 2012, health spending in the U.S. reached an estimated $2.8 trillion, with a modest overall growth rate. The preceding year, 2011, witnessed expenditures of $2.7 trillion, reflecting a growth rate of 3.9 percent—only marginally higher than the 2009 rate. These figures, presented in a federal actuary analysis, highlight the substantial financial footprint of healthcare, averaging $8,680 per person in 2011. The healthcare sector constituted 17.9 percent of the gross domestic product in both 2010 and 2011. The chapter aims to dissect and address the complexities arising from such financial dynamics in the healthcare landscape.

Key Areas of Spending Growth (2011 over 2010):

Physician and Clinical Services Spending (4.3%): Accelerated growth from 3.1% in 2010, driven by increased utilization and complexity of services, outweighing slower price growth.

Medicare Spending (6.2%): Marked increase from 4.3% in 2010, attributed to a one-time surge in spending for skilled nursing facilities and faster growth in physician services and Medicare Advantage spending.

Private Health Insurance (3.8%): Accelerated from 3.4% in 2010, primarily due to a 0.5% increase in private health insurance enrollment in 2011, following consecutive declines from 2008 to 2010.

Retail Prescription Drugs Spending (2.9%): Growth picked up from 0.4% in 2010, influenced by price hikes in brand-name and specialty drugs, although still notably lower than the 2009 figure of 5% growth.

Out-of-Pocket Spending (2.8%): Increased from 2.1% in 2010, driven by higher cost-sharing and a rise in enrollment in consumer-directed health plans.

Areas of Slowed Spending Growth (2011 from 2010):

Medicaid Expenditures (2.5%): Growth decelerated from 5.9% in 2010, impacted by economic pressures on state budgets, a shift in spending share from federal to state governments, and slower enrollment growth.

Hospital Spending (4.3%): Slowed from 4.9% in 2010, attributed to reduced growth in hospital prices, lower utilization of hospital services, and restrained Medicaid spending on hospital care.

While these statistics are dated, they illuminate persistent trends that remain concerning. Throughout this chapter, we'll delve into the factors contributing to these trends and explore both micro and macro strategies to address the ongoing challenge of escalating healthcare costs.

Financing Approaches to Healthcare Programs

Financing Healthcare Programs: Insurance-Based and Self-Insured (Self-Funding)

Organizations navigate two primary avenues for financing their employees' healthcare programs: Insurance-Based Financing and Self-Insured (Self-Funding) approaches.

Insurance-Based Financing:

This prevalent method of financing healthcare programs encompasses four key characteristics:

Pooling of Losses: Spread losses across a group, allowing each employee to pay an average loss rather than the total incurred. This promotes cost sharing and accurate loss predictions with a large sample.

Payments for Random Losses: Insurance operates on the premise that payments are made for unforeseen, random losses.

Risk Transfer: The risk of payment is shifted from the insured to the insurer, who absorbs the risk by collecting premiums.

Indemnification: The insurer compensates the insured, wholly or partially, for expenses arising from illness or injury.

Insurance providers grapple with challenges such as adverse selection (high-risk individuals submitting claims) and moral hazard (employees incurring unnecessary expenses when someone else foots the bill). To counter adverse selection, insurers may charge higher premiums for high-risk employees, known as an underwriting provision. Moral hazard is mitigated through cost-sharing mechanisms like copays, co-insurance, and deductibles.

Traditionally, in a full health plan, the company pays a fixed premium, adjusted only if the number of enrollees increases during the year. The insurer collects premiums, and claims are paid based on policy benefits. Employees may face deductibles or copayments, and insurers often cover a percentage of the customary charge for medical services (co-insurance). Indemnity or fee-for-service plans allow employees to use any provider, with insurers reimbursing a percentage of medical expenses after the deductible is met.

Key components include:

Deductibles: Initial amount paid by the employee before insurer contributions.

Co-insurance: The percentage split between insurer and employee after the deductible.

Out-of-Pocket Maximum: A cap after which covered benefits are fully paid by the insurer.

Lifetime Limits: Ceilings on total benefits paid under the policy.

Experts recommend policies with reasonable lifetime limits, often set at $1 million or more, to ensure adequate coverage.

Self-Insured (Self-Funding):

In contrast to insurance-based financing, the self-insured or self-funding approach involves organizations directly funding their employees' healthcare plans from their general resources. Key features of self-insured plans include:

Direct Funding by Employer: Instead of purchasing insurance, the employer funds the employee's plan directly from company resources.

Flexibility and Control: Self-funding offers greater flexibility and control over plan design, allowing customization based on the organization's unique needs.

Reduced Administrative Costs: By handling claims and administration internally or through third-party administrators (TPAs), organizations may reduce administrative costs associated with traditional insurance.

Cash Flow Benefits: Employers pay claims as they arise, offering potential cash flow benefits compared to prepaying fixed premiums.

Risk Retention: Unlike insurance, where risk is transferred to the insurer, self-insured plans retain the financial risk associated with employee healthcare expenses.

Stop-Loss Insurance: Employers often purchase stop-loss insurance to mitigate the financial risk of catastrophic claims, setting a threshold beyond which the insurer covers costs.

Self-funding is particularly attractive to larger organizations with stable employee populations and financial capacity. It provides the flexibility to design plans tailored to employee needs, potentially resulting in cost savings and increased efficiency. However, the approach also involves assuming greater financial risk, especially without adequate stop-loss coverage. Employers must carefully weigh the benefits and risks before opting for self-insurance.

Utilization Review and Value-Based Benefit Design:

Two important concepts in healthcare financing are Utilization Review and Value-Based Benefit Design.

Utilization Review:

Utilization review involves assessing the appropriateness and necessity of healthcare services to ensure efficient resource utilization. It includes evaluating the medical necessity, quality, and cost-effectiveness of provided services. By scrutinizing healthcare utilization, organizations aim to optimize resource allocation, control costs, and enhance the quality of care. Utilization review processes may be conducted internally or outsourced to specialized entities.

Value-Based Benefit Design: